The Perfect Financial Storm?

A year or so ago, I got on an email list for Mauldin Economics. They had a free geo-political analysis that I was interested in reading.

Anyway, I never unsubscribed so every once in a while, among dozens of other emails trying to get me to buy some program or product, is something actually useful.

Today's email was a link to a report title, "The Perfect Financial Storm? What to Expect in the Next 1-5 Years."

We are entering record-long territory for the longest running bull market. Here are some quotes from the report:

The last statement reminded me of one of the prophesies attributed to John Koyle about the government propping the economy up.

What are the editor's take on the biggest threats to the bull market for the next 12 months? Here are a few comments I thought were interesting.

Kevin Brekke, editor of Rational Bear, said, "But the real concern for me is the debt and rising rates. It’s a really explosive combination that we’re going to have to confront over the next year."

Patrick Cox, editor of Transformational Technology Alert, said, "At some point, something will have to give. And I don’t see it playing out peacefully."

John Mauldin, co-editor of Over My Shoulder, had the most comments I thought were interesting. He said:

Patrick Watson, co-editor of Over My Shoulder, added concern about politics affecting the economy. Like the others, he believes a "recession [is] coming our way" that will "put us in a seriously bad situation." He also thinks we get through things "until November and possibly early 2019. Beyond that, I’m a lot more worried."

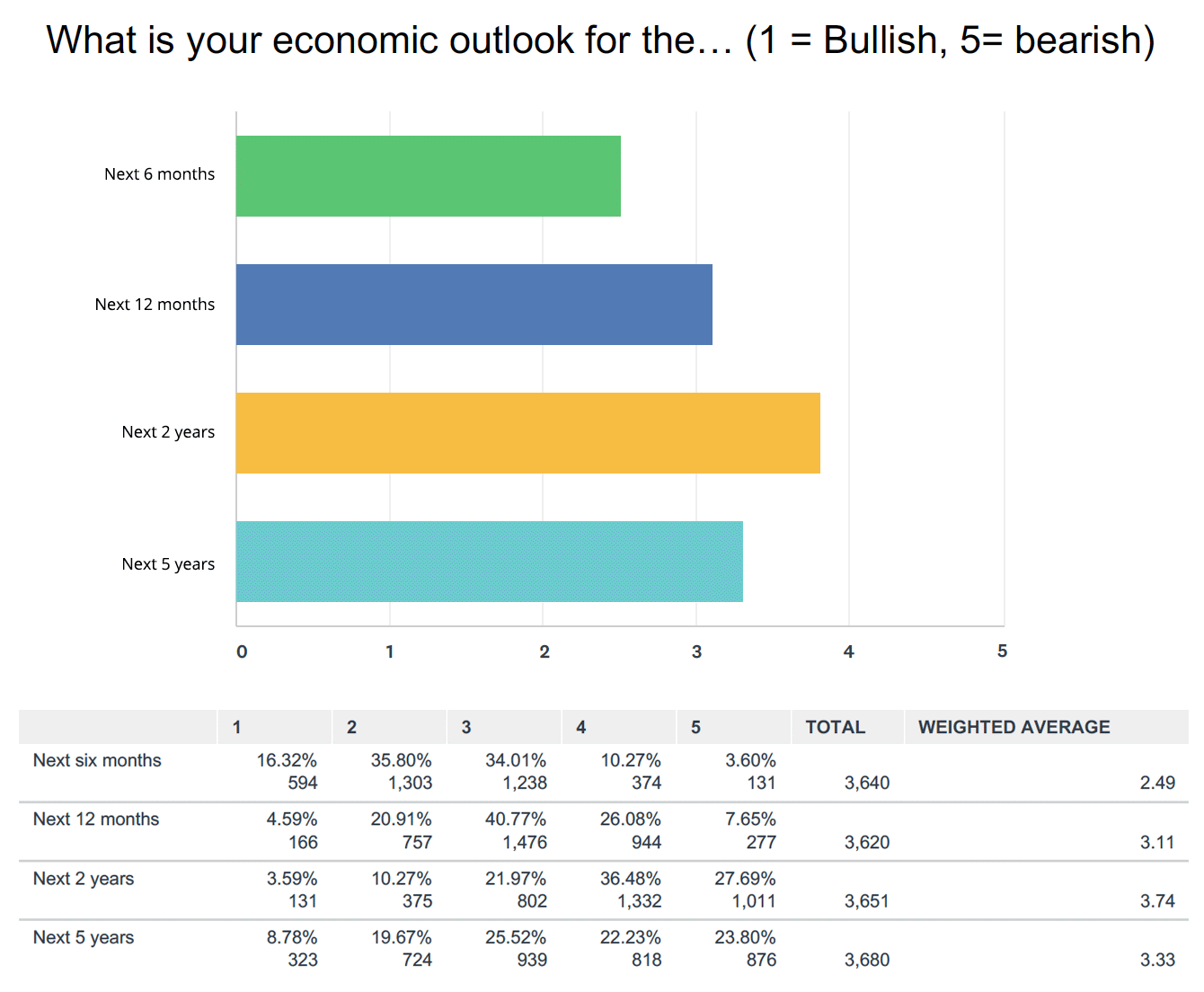

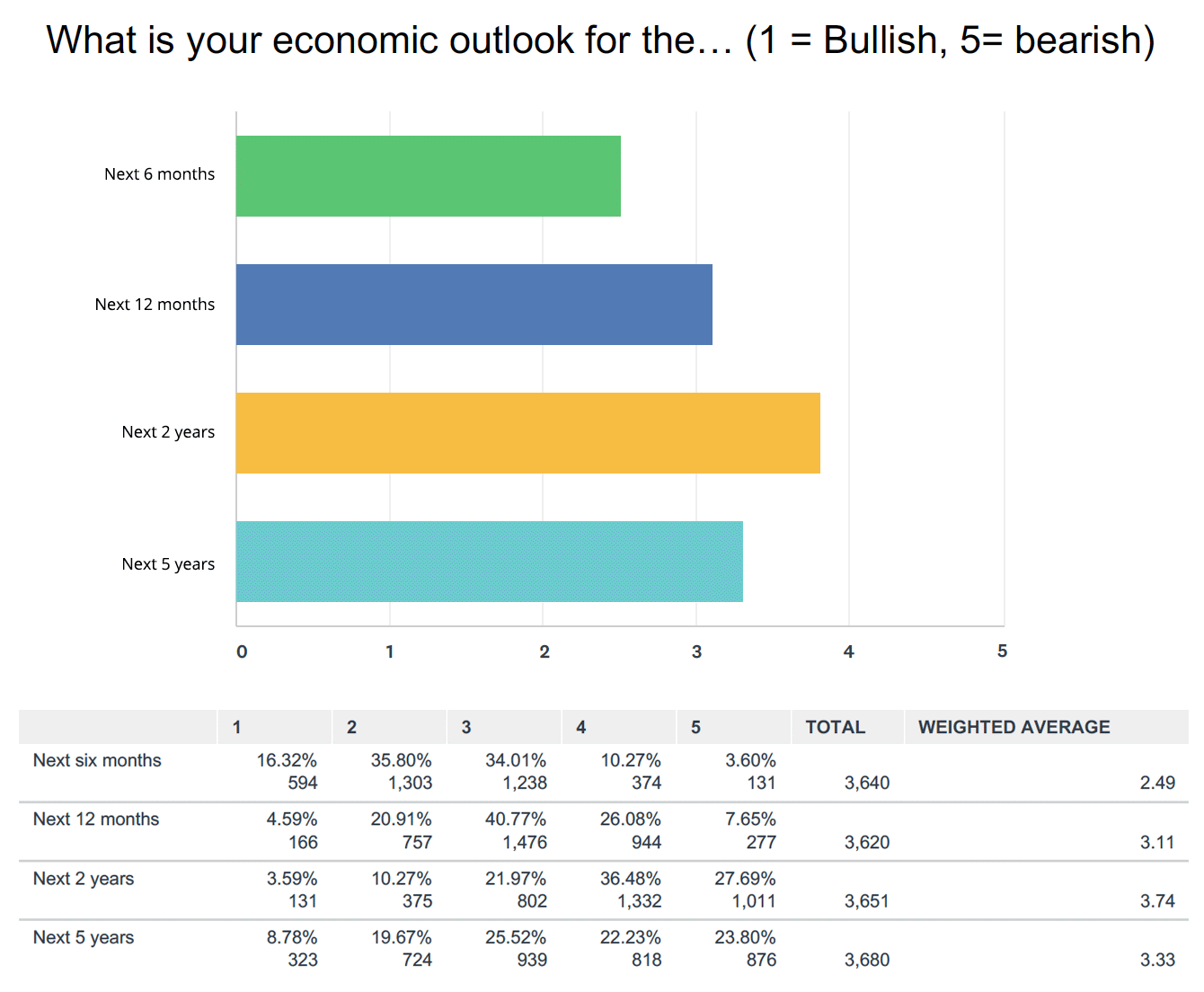

One of the survey questions that was asked of readers and the editors was "What is your economic outlook for the next 6 months, 12 months, 2 years, and 5 years?"

What is interesting is the general consensus is for the next 6 to 12 months the economy is most expected to be bullish (good). It would have been interesting if there was an 18-month mark as well, because by 2 years out the majority see the economy becoming more bearish, and the bear market will continue through the rest of the five years.

Five years out is 2023, which is when I expect market/economic conditions to be improving...right before things will completely fall apart in late 2024. Very few will expect that collapse because the economy will appear to have been improving, and few will be prepared for it.

Back to the report.

The editors were then asked about the economic outlook and when we should expect the next recession.

Patrick Watson said, "I’m short-term bullish, long-term bearish. The dividing line is probably around six months." He also said, "I see a fair chance for a recession in 2019. I think we’ll make it through the rest of this year without it."

Robert Ross, editor of In the Money and Yield Shark, said, "Readers’ biggest concern is monetary tightening, and most of them are bearish 12 months out. I’m a little further out on the time horizon.

The dividing line for me is 18 months."

Assuming the report was assembled in June 2018 (although it could have happened early) and was just made available, it's interesting that 18 months out puts us in November 2019, which is about when I think we might have the official start of the next recession/depression.

Jared Dillian, editor of Streak Freak, The Daily Dirtnap, and ETF 20/20, said, "[Federal Reserve Chairman] Powell is determined to hike interest rates until the yield curve inverts and we get a recession. The question is how long it will take—and these things usually take a really long time to play out. A recession usually happens one to two years after the yield curve inverts. Now, the yield curve might not invert for another year. That means a recession might be two to three years out. It’s crazy."

Anyway, I never unsubscribed so every once in a while, among dozens of other emails trying to get me to buy some program or product, is something actually useful.

Today's email was a link to a report title, "The Perfect Financial Storm? What to Expect in the Next 1-5 Years."

We are entering record-long territory for the longest running bull market. Here are some quotes from the report:

"By late August, the bull market in stocks that followed the 2008 crisis will be the longest ever. But it’s not the length of this bull run that is a problem. What is more concerning are the forces that have driven markets so high."

"Unlike past bull markets, this run was created by an unprecedented level of central bank intervention."

The last statement reminded me of one of the prophesies attributed to John Koyle about the government propping the economy up.

"We are moderately bullish on the market in the short term, but we see more and more reasons for this bull market to end."

What are the editor's take on the biggest threats to the bull market for the next 12 months? Here are a few comments I thought were interesting.

Kevin Brekke, editor of Rational Bear, said, "But the real concern for me is the debt and rising rates. It’s a really explosive combination that we’re going to have to confront over the next year."

Patrick Cox, editor of Transformational Technology Alert, said, "At some point, something will have to give. And I don’t see it playing out peacefully."

John Mauldin, co-editor of Over My Shoulder, had the most comments I thought were interesting. He said:

"Last year, I wrote in great length about what I call the Great Reset, a worldwide debt default I see coming in the next decade.

"The process, I believe, will start with a credit crisis in the high-yield bond market. This is where I see the biggest risk today. And my prediction is that this crisis is 12–18 months out.

"The problem is massive illiquidity. If people want to sell, trading will disappear instantly. The same happened in the dot-com crash and the 2008 financial crisis. Buyers disappeared and high-yield bonds lost more than a third of their value as a result.

"This time, however, I believe the collapse in high-yield debt will be much bigger as Dodd-Frank reduced banks’ ability to cushion it. The Fed won’t be eager to bail out bonds issued by companies like WeWork that are unreasonably priced either.

"As high-yield debt collapses, falling bond and stock prices will hit borrowers. This will be the next stage of this credit unraveling.

"Rising defaults will force banks to reduce lending. Creditworthy business, in turn, will be deprived of capital, which will take a toll on earnings and economic activity.

"Eventually, a recession will follow."

Patrick Watson, co-editor of Over My Shoulder, added concern about politics affecting the economy. Like the others, he believes a "recession [is] coming our way" that will "put us in a seriously bad situation." He also thinks we get through things "until November and possibly early 2019. Beyond that, I’m a lot more worried."

One of the survey questions that was asked of readers and the editors was "What is your economic outlook for the next 6 months, 12 months, 2 years, and 5 years?"

What is interesting is the general consensus is for the next 6 to 12 months the economy is most expected to be bullish (good). It would have been interesting if there was an 18-month mark as well, because by 2 years out the majority see the economy becoming more bearish, and the bear market will continue through the rest of the five years.

Five years out is 2023, which is when I expect market/economic conditions to be improving...right before things will completely fall apart in late 2024. Very few will expect that collapse because the economy will appear to have been improving, and few will be prepared for it.

Back to the report.

The editors were then asked about the economic outlook and when we should expect the next recession.

Patrick Watson said, "I’m short-term bullish, long-term bearish. The dividing line is probably around six months." He also said, "I see a fair chance for a recession in 2019. I think we’ll make it through the rest of this year without it."

Robert Ross, editor of In the Money and Yield Shark, said, "Readers’ biggest concern is monetary tightening, and most of them are bearish 12 months out. I’m a little further out on the time horizon.

The dividing line for me is 18 months."

Assuming the report was assembled in June 2018 (although it could have happened early) and was just made available, it's interesting that 18 months out puts us in November 2019, which is about when I think we might have the official start of the next recession/depression.

Jared Dillian, editor of Streak Freak, The Daily Dirtnap, and ETF 20/20, said, "[Federal Reserve Chairman] Powell is determined to hike interest rates until the yield curve inverts and we get a recession. The question is how long it will take—and these things usually take a really long time to play out. A recession usually happens one to two years after the yield curve inverts. Now, the yield curve might not invert for another year. That means a recession might be two to three years out. It’s crazy."

John Mauldin commented on a dinner he had with "serious market thinkers" a couple of months ago. Here are some of his comments:

"The first question I asked these financial masterminds was, when will the next US recession start?

"The consensus was that we are near the end of this recovery, and a recession is most likely in the second half of 2019.

"Of course, as you’d expect in such a group of people, we had some outliers.

"Jonathan [Golub, Chief US Equity Strategist at Credit Suisse] was certain that the US will plunge into a recession in 2022. There were also a couple of late-2018 guesses.

"Some also think we might see another short rally before things blow up, similar to what happened ahead of the last two recessions.

"As for me, I think recession is most likely in late 2019. Barring a black-swan event, I don’t see it coming this year."

The reality is a big market correction is coming. Anyone who has any experience in the economy knows it is coming, but nobody knows when or how bad it will be. There are economic cycles and, come late August, we will be extending the current up cycle into the longest running bull market. At some point the direction will turn and the bear market returns.

There is a lot of concern that the coming bear market economy will be serious enough to be a recession. My question is what if it's worse?

I've seen very few people actually suggest a depression is coming. It could be that a recession hits in 2019-20 and then the depression strikes in mid-to-late 2024, after multiple mega-disasters and plagues rip through the country.

However, I'm leaning more towards the depression hitting immediately, or very soon, after the economy dives into a recession in late 2019 or 2020. I think what will likely happen in 2024 is a complete economic collapse.

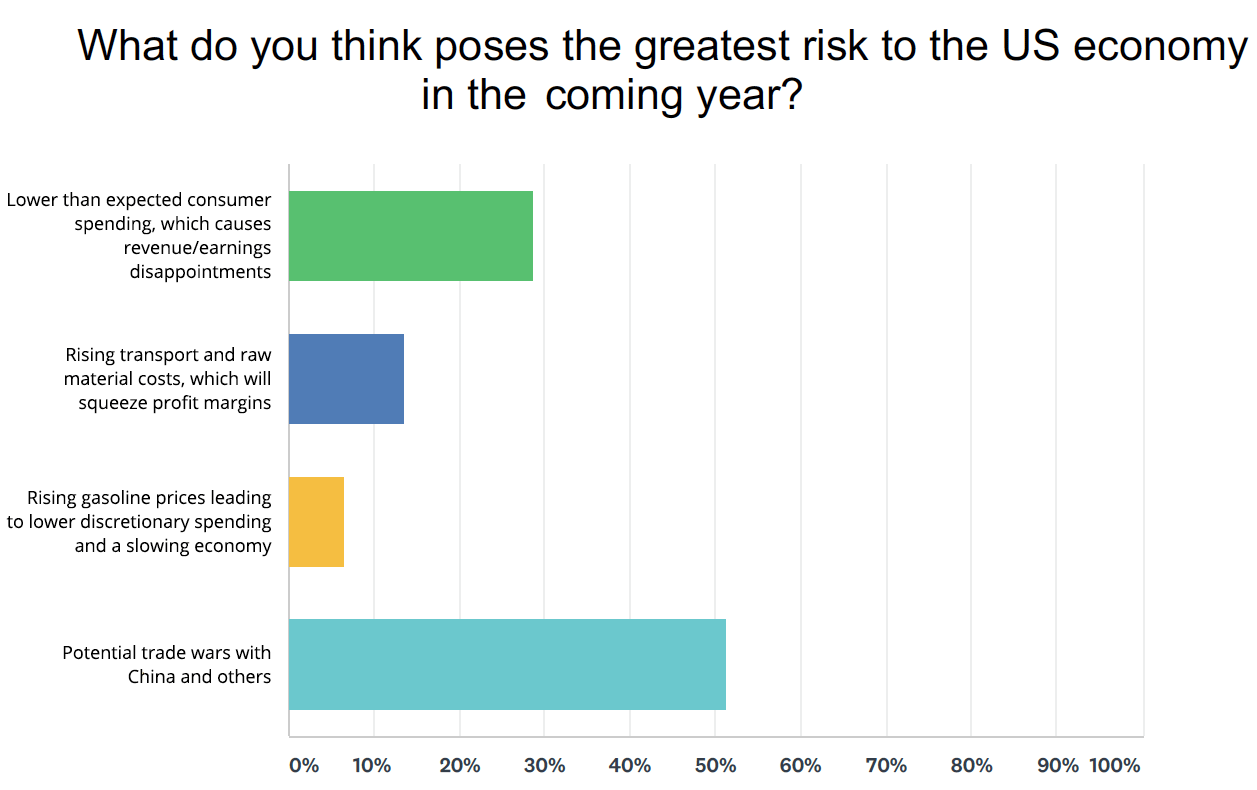

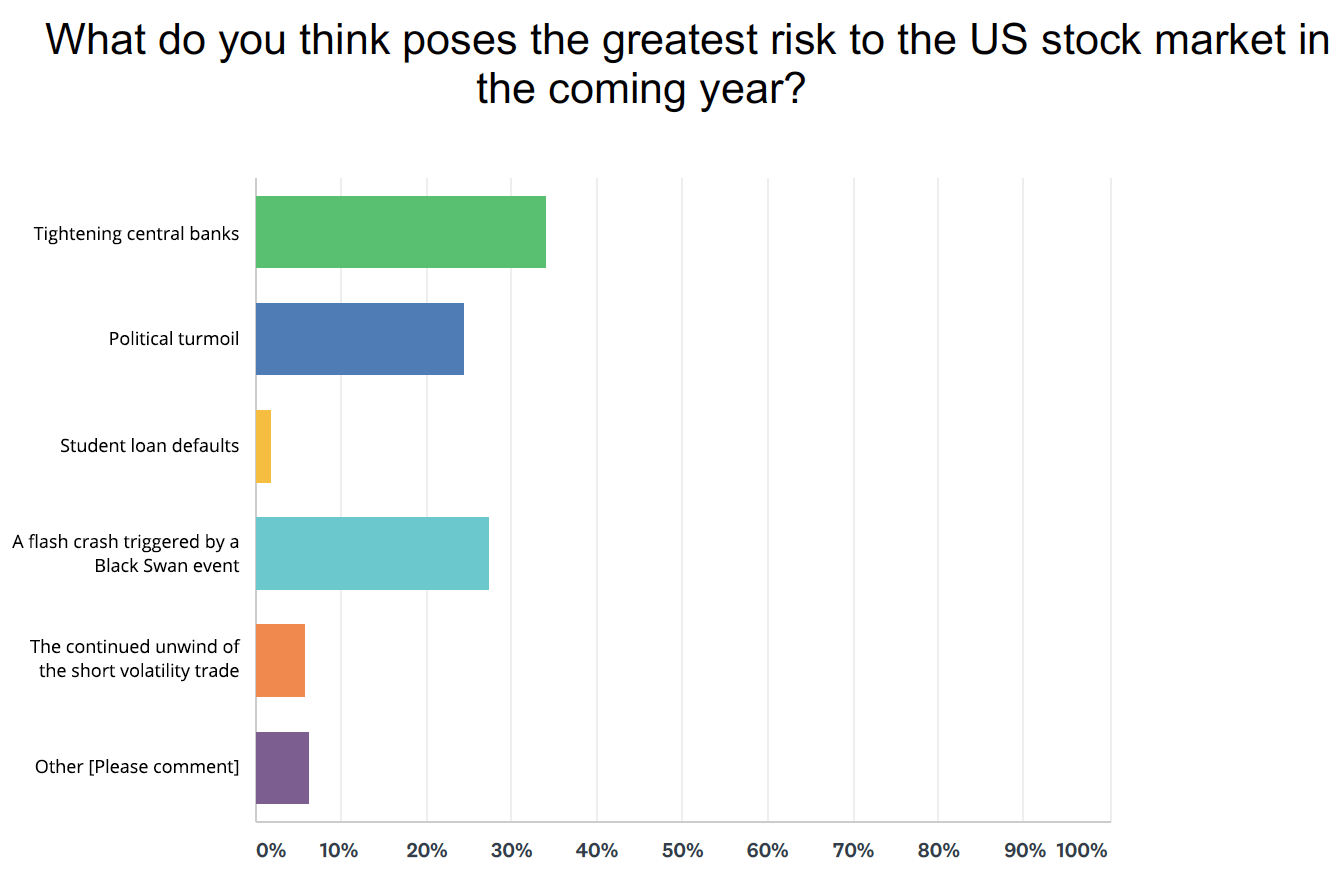

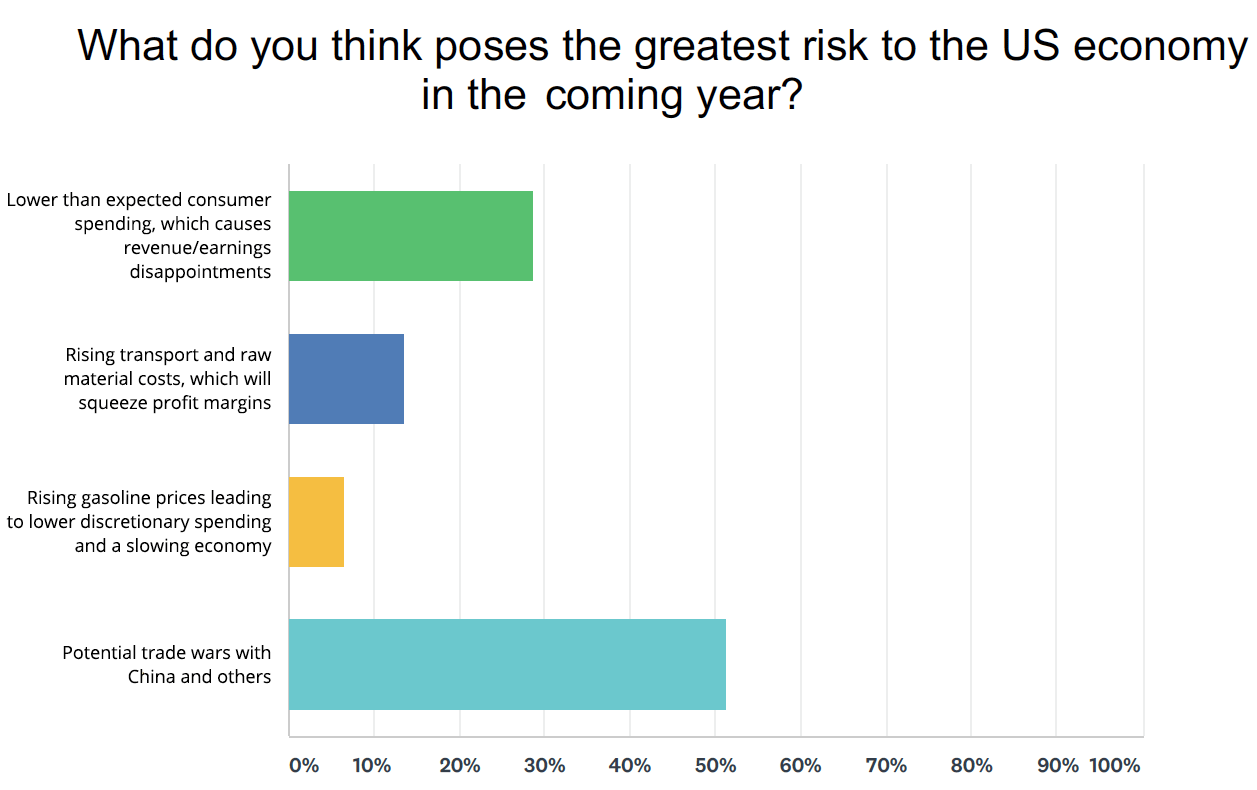

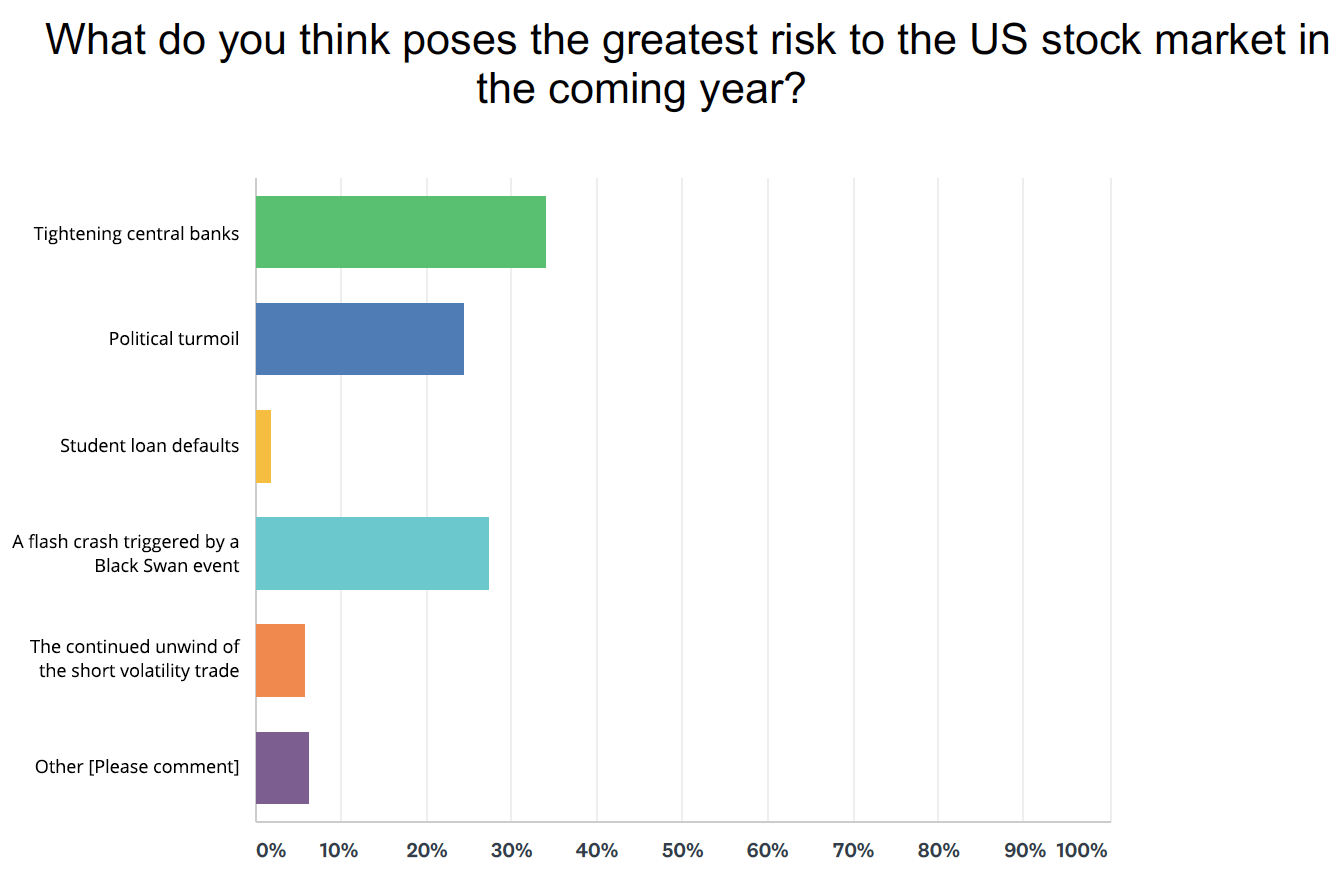

Regarding the greatest risks here are the two graphs from the report:

Supposedly this report is only up until Wednesday, July 18, so this link may not work. In any case, here is the source link for the report I've been mentioning:

I suspect worsening drought/famine conditions will make the coming recession worse, and actually poses a great risk to the US stock market. While not a Black Swan event, it could definitely play a major role in a market crash and the economy's ability to get back to growth.

However, multiple mega-disasters, combined with plagues/pandemics (especially if millions are killed), would severely cripple the economy and they would be black swans. And, with how heavily reliant most of the world is on the US economy, this would strike a disastrous blow to the economies of the world.

Comments

Post a Comment